Payroll and tax in Brazil: Comprehensive Guide for Employers

Brazil’s huge consumer base, highly skilled talent pool, and open attitude to foreign investment make it an ideal market for global companies.

To do business in Brazil or if you’re looking to hire in this country, you have to explore the labyrinth of Brazil’s payroll tax system.

Discover payroll requirements and taxes in Brazil. Whether you’re an employer or an employee in Brazil, this guide is your roadmap through the complex terrain of payroll taxes.

Introduction to Payroll and Tax in Brazil

Managing payroll in Brazil requires precision, expertise, and compliance with strict labor and tax laws. Brazil’s highly regulated payroll system leaves no room for error, and companies must carefully navigate it to avoid fines, legal disputes, and non-compliance penalties.

Due to the complexities of Brazil’s regulatory, tax, and labor rules, businesses must exercise extreme caution when handling payroll. Without proper expertise, errors in calculations or reporting can lead to significant risks and financial penalties.

Key Challenges of Payroll in Brazil

Complex Labor Laws: The Consolidação das Leis do Trabalho (CLT) enforces strict rules on working hours, benefits, and severance pay. For more information, explore our 🔗 Brazil Employer of Record Guide.

Multilayered Tax System: Payroll taxes involve federal, state, and municipal levels, requiring specialized knowledge to ensure compliance.

Frequent Legislative Updates: Changes to labor laws can impact payroll calculations, making timely updates essential to avoid errors.

Social Contributions and Benefits: Employers must accurately calculate mandatory charges, including Social Security (INSS) and FGTS contributions.

Regional Regulations: Brazil’s 26 states and federal district impose varying payroll rules, adding complexity for businesses operating in multiple locations.

Language Barriers: Legal documents are in Portuguese, creating challenges for international companies unfamiliar with the language and cultural nuances.

How to Set Up a Payroll in Brazil?

Setting up payroll in Brazil requires careful planning and strict compliance with labor laws and tax regulations.

➡️ STEP 1: Establish a legal entity

➡️ STEP 2: Register with authorities.

➡️ STEP 3: Open a local bank account

➡️ STEP 4: Adopt the digital payroll system (Esocial)

➡️ STEP 5: Draft employment contracts

➡️ STEP 6: Review Collective Bargaining Agreements (CBAs)

➡️ STEP 7: Maintain Compliance and Updates

To have more details about each step, take a look at our article 🔗 How to set up a Payroll in Brazil?

Simplify and optimize your payroll operations across Latin America.

Let us manage compliance, tax deductions, and filings in every country where you operate. Our dedicated team of in-house payroll experts ensures seamless, accurate, and fully compliant payroll management, so you can focus on growing your business.

Step-by-step Payroll Process in Brazil

Payroll process involve three main stages as shown below:

Pre-payroll stage

To manage payroll in Brazil accurately and compliantly, you need first to establish your legal entity in the country.

To do so, we advice you to dive into payroll requirements and understand payroll inputs so you have a full understanding of payroll in Brazil.

It is crucial to define policies related to:

- Business profile

- Attendance policies

- Salary components

- Employee information

- Pay schedule

Payroll stage

The payroll stage will differs depending on the option you’ll choose.

If you choose to run payroll in-house or to use a payroll software, then your team will be in charge of running the entire payroll process. Then, they will have to feed all data gathered during the pre-payroll stage into the software.

If you choose to outsource payroll via a payroll provider, then you’ll have to send all data so they can process payroll.

Post-payroll stage

Post-payroll stage include all payments, accounting and reporting tasks. The following tasks must be done:

- Salary payment

- Tax payment

- Payroll accounting

- Payroll reporting

How is payroll tax calculated in Brazil?

Calculate employment cost

To calculate payroll taxes in Brazil, the first thing to do is to determine the employees’ salary and additional earnings.

Next calculate the employer taxes and contribution: INSS, FGTS, RAT & Terceiros.

After this step, you’ll know exactly the employment cost of your workforce.

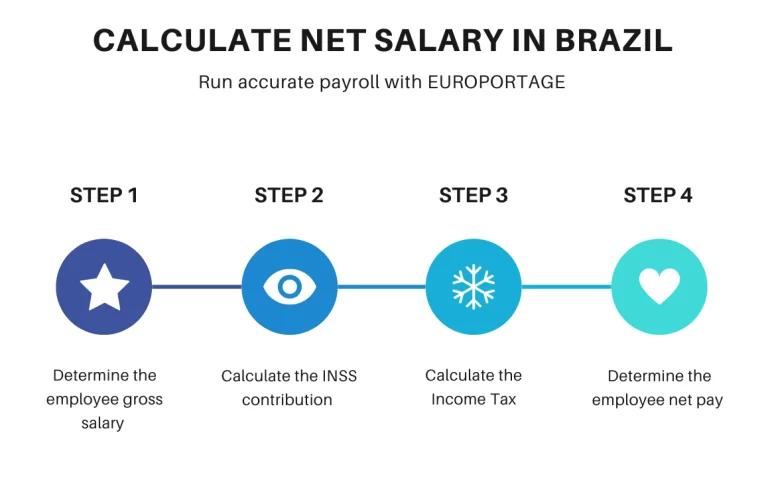

Calculate net salary

To accurately calculate the net salary of your employee, you’ll have to deduce two taxes: the Social Security contribution and the Income tax.

Follow the steps below:

Take a look at our article if you want to have more details about 🔗How to calculate net salary in Brazil.

Key elements of payroll in Brazil

To run payroll compliantly and accurately, gobal companies hiring in Brazil or doing business in the country must dive deep in local payroll and understand requirements so they avoid non-compliance fines and penalties.

Let’s find below some key aspects of Brazilian payroll:

➤ Fiscal year: Brazil’s fiscal year is from January 1 through December 31.

➤ Payroll cycle: In Brazil, payroll is run monthly. Employers must pay wages on the last working day of the month. Depending on the company CBA, employees can be paid twice a month

➤ Minimum salary: In 2025, the minimum salary is R$ 1.518 per month. Minimum salary varies from a state to another. It is also reajusted every year in January.

➤ Overtime: Standard workweek in Brazil is eight hours daily, Monday to Friday, plus four hours on Saturday for a maximum of 44 hours. It is really common to work the full 44 hours during the week.

➤ Notice period: For termination without just cause, employers must give at least a 30-day notice, plus three days for each year of the employee’s service up to 90 days maximum (one year equates to 30 days of notice, two years equates to 33 days of notice, etc.).

➤ Pension funds & Severance, the case of FGTS: Employer must pay a 8% contribution named FGTS. In case of termination without just cause, employers must pay the employee 40% of the total sum of the employee’s FGTS account

➤ Leave & PTO: All employees in Brazil who have worked for their employer for at least 12 months are entitled to 30 days of paid annual leave.

➤ Maternity & Paternity leave: Employed mothers have the right to 120 calendar days of maternity leave. Employed fathers gave the right to 5 days of paternity leave. Find more about parental leave in Brazil.

Mandatory Payroll Taxes in Brazil

Both employers and employees must pay several taxes and contributions in Brazil as part of the Brazil payroll requirements.

Legal employer in Brazil must pay mandatory payroll taxes and contributions in Brazil including Social Security (INSS), pension fund (FGTS), work accident insurance (RAT), and social tax named Terceiros.

Depending on salary, employees must also contribute to the Social Security (INSS) and the Income tax.

We discuss each of Brazil’s mandatory payroll taxes and contributions in detail below ⬇️

Employer taxes

Statutory payroll taxes and contributions in Brazil include Social Security (INSS), a pension fund (FGTS), work accident insurance (RAT), and social tax names Terceiros.

Social security contribution (INSS)

The acronym INSS stands for Instituto Nacional do Seguro Social, an agency of the Ministry of Social Security.

Generally, the employer contribution is equivalent to either 20% or 22,5% of the gross monthly salary and without a cap.

Severance & Pension fund (FGTS)

Basically, it a fund created by the employers for each employee which covers the severance indemnity. It is possible for employees to accumulate several FGTS accounts, depending on the jobs they have held.

The FGTS is made up of the total of these monthly deposits. The total amount belongs to the employee who can dispose of the total deposit in some cases. The deposit is equivalent to 8% of the gross monthly salary.

Work accident insurance (RAT)

The Risco Ambiental do Trabalho (RAT) is a social security contribution. Basically, the RAT tax is the working accident contribution the company needs to pay to cover work-related injuries.

The rate applied for the coverage of this insurance can be:

- 1% for the company in whose activity the risk of work accident is considered light;

- 2% for companies with a medium work accident risk;

- 3% for companies with a work accident risk considered severe.

Social tax (Terceiros)

This tax is another contribution to governmental institutions related to employee’s fund for training. This tax includes the following taxes : SENAI, SESC, SESI, etc.

The contribution stands usually at 5,80% of the gross monthly salary.

Additional payroll contributions in Brazil

In addition to the above payroll taxes and contributions, employers in Brazil must offer employees a 13th-month salary and vacation bonus and comply with applicable CBA-mandated contributions.

13th-month Salary

13th-month bonus is a compensation in Brazil given to employees at the end of the year in twor installments. While it may seem like a Christmas bonus, 13th month pay isn’t a optional benefit; it’s part of employment law, so employers must pay it.

Learn more about the 13th month salary in Brazil.

Vacation Bonus

The second mandatory benefit in Brazil is the vacation bonus. In Brazil, employees are entitled to a minimum holiday period of 30 days. However, employees need to complete a 12 months of work to benefit from it.

When leaving on holidays, the employee is entitled to his normal pay and a vacation bonus which equals to one third of the gross salary.

Transportation vouchers

All employees under the CLT regime, including those hired on a temporary basis, benefits from transportation vouchers. Commutes longer than 1 kilometre are paid by the company.

The benefit does not apply if the employee is working remotly.

CBA-mandated contributions

Employers must also comply with applicable CBA-mandated contributions, such as life insurance or meal vouchers, and deduct and remit federal income taxes on employee gross earnings.

Employee contributions

Statutory employee taxes and contributions in Brazil include Social Security (INSS) and Income tax

Social security contribution (INSS)

The first calculation corresponds to the amount that goes to Social Security. From the gross salary, the deduction is made according to the following table:

| MONTHLY SALARY | RATE |

| Until R$ 1.412,00 | 7,5% |

| From R$1.412,01 to R$2.666,68 | 9,0% |

| From R$2.666,69 to R$4.000,03 | 12,0% |

| From R$4.000,04 to R$7.786,02 | 14,0% |

*updated 24/01/2024

Income tax (IR)

The Income Tax is an annual tax levied on the individuals and companies’ incomes by the Federal Government. The government requires workers and businesses to report their annual income to the Receita Federal. The taxpayer needs to report all service income and expenses for the previous year.

The period is usually from the beginning of March to the end of April.

The amount deducted from the employee’s salary depends on his monthly income according to the following table:

| CALCULATION BASIS | RATE |

| Until R$ 2.259,20 | 0,0% |

| From R$ 2.259,21 to R$ 2.828,65 | 7,5% |

| From R$ 2.826,66 to R$ 3.751,05 | 15,0% |

| From R$ 3.751,06 to R$ 4.664,68 | 22,0% |

| Above R$ 4.664,68 | 27,5% |

* updated 01/2024

Payroll options in Brazil

Running payroll for distributed team can be tricky and most global companies uses the following methods: in-house payroll administration, payroll software or local payroll outsourcing provider.

We discuss each method in detail below.

In-house payroll

If you already hav a Brazilian legal entity, one of your option is to run payroll internally. To do so, you’ll have to source and hire payroll teams so they can administer payroll in-house.

This option gives you complete control over the payroll process and you’ll be fully in charge of compliance. Even if it seems a good option, it can be tricky to navigate local regulations whens starting a business. Also, sourcing, hiring and training your own team can be more expensive than outsourcing your payroll.

Payroll software

The payroll software is the perfect option for start-up and small businesses.

It allows small team to run payroll without spending a lot of money.

Local payroll outsourcing

Outsourcing payroll to a local payroll outsourcing provider is usually a wining strategy for businesses of all sizes. The partner handles payroll calculations, taxes and compliance on your behalf so you can focus on your core business.

The challenge when opting for local payroll outsourcing is the level of control that you’ll have. Indeed, it usually limits visibility into the payroll process, making it difficult to resolve payment errors and delays.

Simplify payroll and taxes in Brazil with Europortage

Payroll and taxes in Brazil are complex especially when it comes to compliance. That’s why we recommend working with a direct and local partner like Europortage.

Our team of local experts is on hand to support you throughout the entire employee lifecycle, including time-off management. We can give you clear advice on business incorporation and global hiring, in addition to handling employment contracts, payroll, and benefits. That way, you can focus on growing a world-class team and business.

Get in touch to find out more and start hiring top talent in Latin America!