Work regimes in Brazil: CLT, RPA & PJ

Want to onboard an employee in Latin America ?

Understanding the different work regimes in Brazil is essential for both employers and employees to ensure compliance with labor laws and to optimize the work arrangement for various needs.

There are two primary work regimes for hiring in Brazil:

- The employee regime governed by CLT (Consolidation of Labor Laws) legislation.

- The independent contractor regime, which can follow either the RPA (Autonomous Payment Receipt) or PJ model(Legal Entity).

Each regime has distinct characteristics, benefits, and requirements.

To fully grasp the working regime landscape in Brazil, we will examine the different models and the distinctions between CLT, RPA, and PJ regulations.

The Employee Regime: CLT in Brazil

Definition

The Consolidation of Labor Laws (CLT) is the primary legislation governing employment relationships in Brazil. Enacted in 1943, CLT establishes the legal framework for employee rights and employer obligations, ensuring comprehensive protection and standardization in the labor market.

To establish this contractual relationship, the following conditions must be met:

- Individual Status (Pessoa Física): The worker must be a natural person, not a legal entity.

- Personal Nature (Pessoalidade): The worker cannot be substituted by another person.

- Continuity (Não eventualidade): The work must be performed on a regular and ongoing basis.

- Economic Dependency (Onerosidade): The worker receives a consistent salary, indicating financial reliance.

- Subordination (Subordinação): The worker must adhere to the employer’s rules and directives.

Conditions

The CLT regime in Brazil offers several key features for employees. Firstly, employees have a formal employment contract with the company, ensuring clear terms and conditions. Secondly, workers are entitled to a range of benefits, such as paid vacation, a 13th-month salary, social security, a severance fund (FGTS), and health insurance, providing substantial financial and social security. The employer ensures minimum conditions and a standard benefits package that includes:

- FGTS (Fundo de Garantia do Tempo de Serviço): A mandatory 8% monthly deposit of the employee’s salary.

- Annual Paid Holidays: Employees are entitled to 30 calendar days of paid leave after one year of service.

- 13th-Month Salary: An extra month’s salary paid annually based on full remuneration.

- Transportation Voucher: Legally required for all employees.

- Meal Voucher: Food allowance value determined by collective agreements.

- Health Care: A welfare contribution of 20% of the employee’s salary.

Lastly, employees enjoy job security with legal protections, including regulations on working hours, overtime, and detailed termination procedures, safeguarding their employment stability.Learn more about the labor laws in Brazil.

Termination

Termination under the CLT can occur in various forms:

- Without Cause: Employers can terminate employees without cause, provided they pay the necessary severance, including prior notice, proportional 13th-month salary, unused vacation, and a 40% FGTS fine.

- With Cause: Termination for misconduct or other justifiable reasons, where employees forfeit certain severance benefits.

- Employee Resignation: Employees can resign by providing prior notice and are entitled to some benefits.

The employer who wants to terminate the employment contract must give notice to the employee, both in the case of resignation or termination without cause. Also, notice varies between 30 days and 90 days depending on seniority. In case of termination for misconduct, it does not require prior notice.

Tax treatment

In Brazil, the CLT regime’s tax treatment encompasses several mandatory contributions. Employers must pay nearly 28% of the total monthly compensation as a social security contribution. Additionally, there is the RAT (Work Accident Insurance), a social tax varying from 1% to 3% based on the company’s risk level. Employers also need to pay the « Terceiros » tax, which is 5.8% of the total monthly compensation. These contributions ensure comprehensive employee benefits and protections under the CLT framework.

RPA (Recibo de Pagamento Autônomo)

Definition

RPA is a regime used for autonomous workers, freelancers, and contractors. It allows for the payment of individuals without establishing a formal employment relationship.

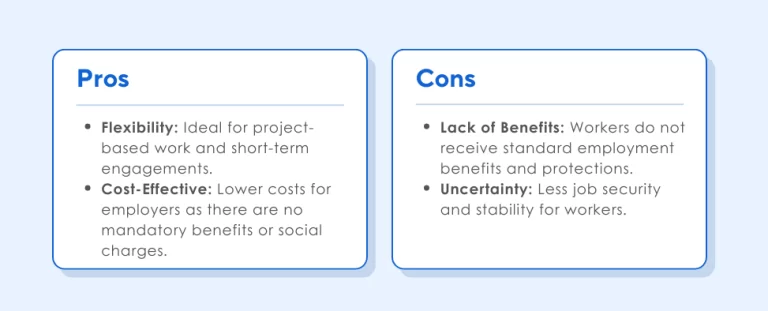

Conditions

The RPA (Recibo de Pagamento Autônomo) regime in Brazil applies to autonomous workers, freelancers, and contractors. Under this regime, workers do not have a formal employment contract and are not entitled to CLT benefits such as paid vacation or a 13th-month salary. Instead, they work on a project basis, receiving payment for their services without the security of traditional employment benefits. Workers under RPA are responsible for managing their own taxes and social security contributions, offering greater flexibility but less stability compared to traditional employment.

Termination

Termination under the RPA (Recibo de Pagamento Autônomo) regime in Brazil is straightforward due to the lack of a formal employment contract. Since RPA workers are considered independent contractors, termination terms are typically outlined in the service agreement between the worker and the employer. There are no statutory severance payments or job security protections as found in the CLT regime.

The employer can end the contract upon completion of the agreed services or as stipulated in the contract.

Tax treatment

For the RPA regime in Brazil, the contracting party is obligated to pay the social security contribution, which amounts to approximately 20% of the total monthly compensation paid to the contractor.

PJ (Pessoa Jurídica)

Definition

The PJ (Pessoa Jurídica) work system in Brazil designates a professional who operates through a registered company and handles all associated costs for providing services. Common forms of PJ include MEI (Individual Micro-entrepreneur), ME (Microenterprise), and EI (Individual Entrepreneur). These professionals work for multiple companies without an employment relationship, as they are contracted for specific tasks with set timelines.

Contracting parties avoid CLT-associated charges like FGTS, INSS, paid vacations, and Christmas bonuses. While the PJ contract allows activity outsourcing, it’s not recommended for long-term or renewable tasks. Such scenarios risk legal action from the PJ to claim employee status and CLT rights.

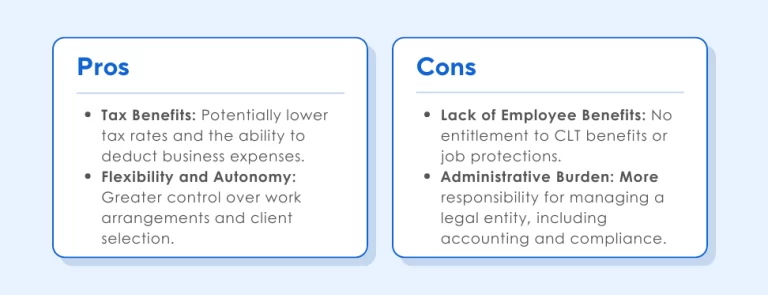

Conditions

Under the PJ regime, individuals create a company, typically a sole proprietorship or limited liability entity, and provide services to clients under a service agreement. This arrangement offers significant flexibility and autonomy compared to traditional employment. PJ workers handle their own invoicing, accounting, and compliance with tax regulations.

Termination

Termination of a PJ contract is typically governed by the terms outlined in the service agreement between the contractor and the client. Unlike traditional employment, there are no statutory protections or severance payments. Both parties must adhere to the contractual terms regarding notice periods and grounds for termination.

Tax treatment

For PJ contractors, tax treatment is distinct from traditional employment. Instead of the typical employee income tax, PJ contractors pay taxes on their company’s profits. This often results in lower tax liabilities, especially when considering allowable business deductions. The contractor’s legal entity must pay corporate taxes, and the contractor can then withdraw funds as dividends, which may be taxed at a lower rate.

Manage work regime in Brazil with Europortage

Manage work regime in Brazil is complex especially when it comes to compliance. That’s why we recommend working with a direct and local partner like Europortage.

Our team of local experts is on hand to support you throughout the entire employee lifecycle, including time-off management. We can give you clear advice on business incorporation and global hiring, in addition to handling employment contracts, payroll, and benefits. That way, you can focus on growing a world-class team and business.

Get in touch to find out more and start hiring top talent in Latin America!