Argentina Employer of record (EOR)

Europortage Argentina Employer of Record (EOR) solution makes it easy for you to hire your talent in Argentina.

An employer of record is a third party that act as the legal employer in the country, so you can hire your talent without having to setup a legal entity.

The employer of record (EOR) has extenseive knowledge and local expertise and takes care of all Argentina compliance aspects of employment, including payroll management, taxes, statutory employee benefits, employment contracts, severance pay and more.

The employer of record is responsible for:

✔️ Drafting local compliant contracts

✔️Process payroll accurately and on time

✔️ Provide the best employee experience

✔️Seamlessly handle global mobility

✔️ Pay your talent in local currency

Employment taxes in Argentina

When hiring in Argentina, employers must comply with a set of mandatory contributions that ensure employee welfare and compliance with local regulations.

Using an Employer of Record (EOR) in Argentina can streamline this process, as the EOR handles these obligations on your behalf.

Pension Fund - 10,77%

mployers contribute to Argentina’s pension fund system by making a mandatory social security contribution. They contribute 10.17% of the employee’s gross salary directly to the pension fund.

This obligation ensures that employees receive adequate benefits during their retirement, and it forms part of the overall social security system in the country

Medical coverage for pensioners 1,59%

Employers are required to contribute 1.5% of the employee’s salary to support the medical coverage for retired individuals.

This is a separate contribution from general health insurance.

Family assignment 4,70%

Employers contribute 4.70% to the Family Assignment system, which provides benefits to workers with dependents. This ensures families receive the financial support they need in case of job loss or other qualified situations.

Health Insurance - 6%

Health insurance in Argentina is managed through a system of trade union-controlled healthcare plans, called Obras Sociales. Employers must contribute 6% of the employee’s salary to the national health insurance system. This system ensures access to medical care for workers and their families.

National Employment Fund - 0,94%

In Argentina, the National Employment Fund (Fondo Nacional de Empleo) is a critical component of the country’s social security system, designed to support workers who are unemployed. Employers must contribute 0.94% of an employee’s gross salary to this fund.

The National Employment Fund plays a key role in financing unemployment benefits, which provide temporary financial assistance to workers who lose their jobs involuntarily. Additionally, the fund supports various employment retraining programs aimed at helping unemployed workers reintegrate into the labor market, improving their skills and employability.

Labor Risk Insurance - 2,12%

Employers must provide Labor Risk Insurance (ART) to cover workplace accidents and occupational diseases. This insurance includes a fixed cost, averaging 0.60%, and a variable percentage based on the job’s risk level, averaging 2.12%.

Employee taxes in Argentina

In Argentina, employees are subject to various taxes and contributions that support pensions, medical coverage, and other social security programs.

Residents of Argentina are taxed on their worldwide income, which includes all sources of domestic and international earnings.

Pension fund - 11%

The pension system in Argentina is funded by mandatory employee contributions, typically amounting to 11% of the employee’s gross salary.

This contribution goes toward retirement and disability benefits under the national pension scheme.

Medical coverage for pensioners - 3%

Under Law 19032, employees are required to contribute toward medical coverage for pensioners, which is funded by a small percentage, 3%, deducted from employees’ salaries. This coverage ensures that retirees receive ongoing healthcare benefits through the public healthcare system.

Employee medical coverage - 3%

Active employees must also contribute 3% of their gross salary for general health insurance. This insurance, commonly managed by employer-sponsored programs called Obras Sociales, provides access to healthcare services during employment.

Employees may choose to make additional voluntary contributions to improve their healthcare coverage.

Statutory Benefits in Argentina

Employees in Argentina must receive certain mandatory benefits as:

13th month salary

Argentines enjoy an Aguinaldo (SAC – Sueldo anual complementario), otherwise known as a 13th-month salary. The 13th month salary is paid in two installments: half in June and half in December. While it may seem like a Christmas bonus, 13th month pay isn’t a optional benefit; it’s part of employment law, so employers must pay it.

Allowance for remote workers

Employers must provide a home office allowance for remote workers .

Common Non-mandatory Benefits in Argentina

Employee mandatory benefits and conditions are legal rights. Then employer are not allowed to make change to the employment terms. However, the can add extra common benefits to attract and retain talents.

Kindly note that depending on the company CBA, some non-mandatory benefits can actually be mandatory.

Meal vouchers

Meal vouchers are a really common benefits in Argentina. In general, the benefit is offered as a card with a cash value that can be used in the company’s canteen or in partner restaurants.

Food vouchers

This benefits is quite common in Argentina. It allows the employee to buy food in grocery stores and supermarket.

Food vouchers are usually granted alonside meal vouchers.

Private Health Insurance

Medical assistance is one of the benefits most valued by professionals. Many companies offer different health plans according to the professional’s position. Other companies offer both health and dental plans together. And some companies extend the benefit to the employees’ families.

Transportation Allowance

Transportation allowance is a common benefits provided by large companies in Argentina.

It usually depends on distance between workers home and office.

Payments in Argentina

Minimum wage

From the 1st of March 2024, the minimum wage in Argentina stands at ARS 202,800 per month (= $230 USD).

Payroll frequency

Employees in Argentina are generally paid monthly with employees being paid as stipulated in employment contract. Employees with per-project agreements are usually paid weekly or bi-weekly.

Payday

Employees receive their payments based on the agreed frequency with their employer. When paid monthly, they typically receive their salary on the last working day of the month.

However, when the payment schedule is bi-monthly, employees usually receive one portion on the 15th and the other on the 30th.

These dates ensure consistency, allowing employees to plan their finances accordingly.

Working time and overtime in Argentina

Working hours

In Argentina, law nº 11.544 governs working hours, setting the standard workweek at 48 hours with a maximum of 8 hours per day.

However, this 48-hour limit can be distributed unevenly throughout the week, as long as no single day exceeds 9 working hours.

Certain circumstances, such as night shifts, jobs involving minors under 18, or tasks deemed hazardous to health, require additional reductions in working hours to ensure worker safety and well-being. These regulations aim to balance productivity with the protection of employee rights

Overtime

In Argentina, the standard workweek consists of 48 hours, and any hours worked beyond this limit are considered overtime. Overtime must be compensated, with employees earning 1.5 times their regular salary for these additional hours. However, there are limits in place: overtime cannot exceed 3 hours per day, 30 hours per month, or 200 hours annually.

Moreover, overtime worked during Saturday afternoons, Sundays, or public holidays is paid at double the normal rate. It’s important to note that employers cannot force employees to work overtime, and employees have the right to decline such requests if they wish.

Contact our team for the most up-to-date information!

Probationary period

The probationary period in Argentina is three months.

The employment relationship begins on the day the worker is registered with AFIP, and on that same day the probationary period begins.

During the three-month probationary period, either party can terminate the contract with only 15 days’ notice or payment in lieu of notice. Both parties may terminate the relationship during this period without just cause and without entitlement to compensation.

Leave in Argentina

Annual leave

In Argentina, annual leave entitlements vary based on the employee’s seniority:

- For less than 5 years of service, the employee is entitled to 14 calendar days of annual leave

- Between 5 to 10 years of service, the employee is entitled to 21 calendar days of annual leave

- Between 10 to 20 years of service, the employee is entitled to 28 calendar days of annual leave

- For more than 20 years of service, the employee is entitled to 35 caldendar days of annual leave

Public holidays

The official public holidays in Argentina are:

DATE | HOLIDAY |

| 1/1 | New Year’s Day |

| Day 48 and 47 before Easter | Carnaval* |

| 24/3 | Day of Remembrance for Truth and Justice |

| 2/4 | Day of the Veterans and Fallen of the Malvinas War |

| 15/4 | Good Friday |

| 1/5 | Labour Day |

| 25/5 | May Revolution |

| 17/6 | Anniversary of the Passing of General Martín Miguel de Güemes |

| 20/6 | General Manuel Belgrano Memorial Day |

| 9/7 | Independence Day |

| 17/8 | General José de San Martín Memorial Day |

| 12/10 | Day of Respect for Cultural Diversity |

| 20/11 | National Sovereignty Day |

| 8/12 | Immaculate Conception Day |

| 25/12 | Christmas Day |

Sickness and disability leave

Article 208 of the LCT grants employees in Argentina the right to sick leave, and the duration depends on their seniority.

- Employees with less than 5 years of service can take up to three months of paid sick leave per year.

- Meanwhile, employees with more than 5 years of service are eligible for up to six months of paid sick leave annually.

This structure ensures that workers receive adequate support during illness, with longer tenures offering extended benefits.

Paternity and maternity leave

Female employees in Argentina receive 90 days of paid maternity leave, typically divided between pre- and post-birth. Employers are prohibited from terminating these employees starting seven and a half months before and after childbirth, ensuring job security during this period. Additionally, mothers are entitled to their full salary and benefits throughout the leave.

Fathers, on the other hand, are granted two days of paid leave following the birth of their child, providing support during this critical time.

End of employment in Argentina

In Argentina, employment can be terminated without cause at any time, provided the notice period is respected (or paid in lieu) and the employee receives their severance pay.

Termination notice period

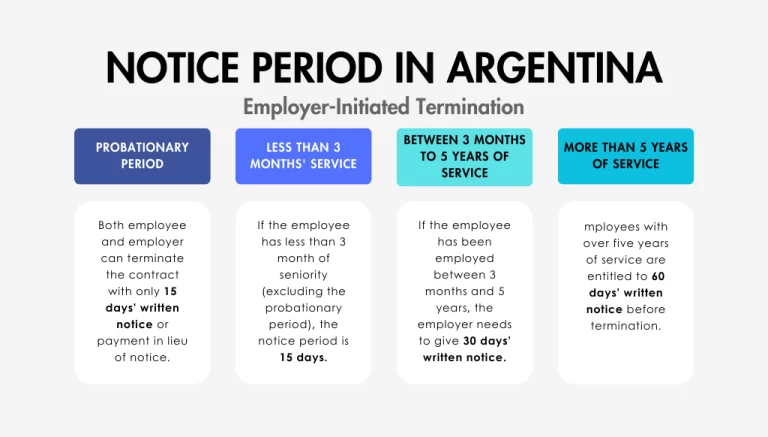

In Argentina, the notice period depends on who initiates the termination and the employee’s length of service.

Employer-Initiated Termination

The notice period varies based on seniority when the legal employer terminates an employee. See below:

For small businesses, the maximum notice period is 30 days, regardless of the employee’s seniority.

Legal employers can choose to pay the notice in lieu.

Employee-Initiated Termination

In Argentina, employees can resign at any time as long as they provide a 15 days’ written notice to their employer.

Severance pay

In Argentina, employees are entitled to severance pay under specific termination scenarios:

Termination Without Just Cause

When an employer terminates an employee without just cause in Argentina, the employee becomes eligible for severance pay, commonly known as “Despido.”

The severance amount equals one month’s salary for each year of service. In cases where the employee has completed at least three months of an incomplete year, they are entitled to an additional month’s salary as compensation.

Additionally, collective bargaining agreements (CBAs) may establish higher severance minimums than the legal requirements, ensuring extra protection and benefits for employees in specific industries or unions.

Termination with Just Cause

In Argentina, no notice nor severance pay are required in case of termination with just cause.

Voluntary Resignation

In Argentina, no severance pay is required for voluntary resignation.

Probation period

No severance pay is due in case of termination during the probation period.

How to hire in Argentina?

Entity setup

Establish a legal entity in a specific country will allow your business to operate legally in the country, hire, pay and manage your talents there.

Independent contractor

This solution might seem a good fit to reduce the cost of setting up an entity or hiring a full-time employee. Engaging a contractor can be a winning strategy in some cases and will depend of your business strategy and goals. For instance, it is a great solution when you need a talent for a short-term project.

Use an Employer of record in Argentina

Partner with an Argentina employer of record (EOR) is quite a game changer and can help you hire globally. The EOR will be the legal employer, which means they will handle employment contracts, onboarding process, compliance, benefits, payroll and more.