Calculate net salary in Brazil

Understanding how to calculate net salary in Brazil is essential for companies hiring locally. Brazil has one of the most structured payroll systems in Latin America, with mandatory deductions that include INSS, IRRF, and category-specific contributions. Each step must follow federal rules, and payroll errors can create compliance issues, fines, or employee dissatisfaction.

If you’re new to Brazil, our 🔗 Payroll & Tax Guide offers an excellent overview of employer obligations.

This guide explains how gross-to-net calculations work in Brazil and offers a practical walkthrough of how to calculate IRRF (Income Tax Withheld at Source). You will find updated salary brackets, deduction rules, and real examples to help you manage payroll correctly. By mastering these steps, employers can process payments accurately and maintain full compliance with Brazilian tax regulations.

What Affects Net Salary in Brazil?

Brazilian payroll starts from the employee’s gross salary, which includes the base salary and additional earnings such as overtime, night shift premium, and bonuses. From this amount, employers must deduct:

INSS (Social Security Contribution) — full rules here: 🔗 Social Security Tax in Brazil

IRRF (Withholding Income Tax) — detailed guide here: 🔗 Brazil’s Income Tax Guide

Other mandatory deductions, such as alimony or benefit co-payments.

Gross-to-net accuracy also depends on proper documentation. For guidance on payslip structure, visit: 🔗 Payslips in Brazil.

Understanding each payroll element makes it easier to determine the actual take-home salary and total employer cost.

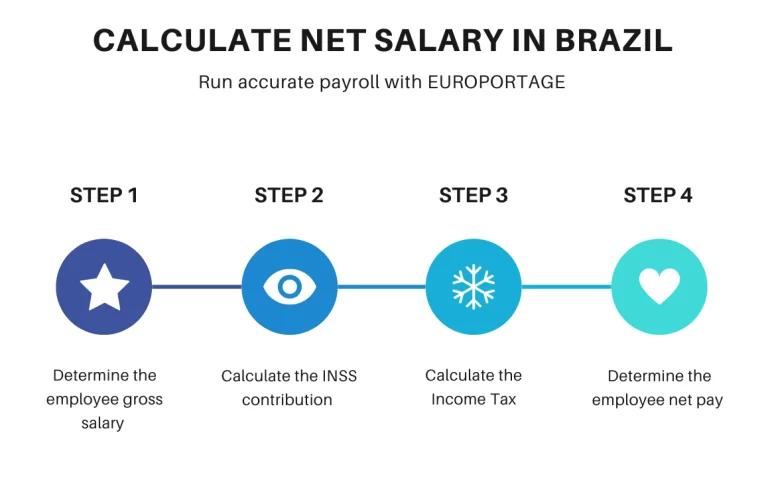

Step 1 : Start With the Employee's Gross Salary

The first step in calculating net salary is identifying the gross salary, which includes fixed pay plus variable components such as overtime, night shift premiums, hazard pay, and bonuses.

A clear structure avoids payroll disputes and ensures correct taxation. Many foreign employers underestimate how many earnings integrate into Brazil’s payroll base. For a holistic view of how earnings affect employer cost, see our 🔗 Payroll & Tax Guide.

2. Deduct the INSS (Social Security Contribution)

Next, deduct the employee’s INSS contribution. INSS uses a progressive table ranging from 7.5% to 14%, applied to different salary brackets until reaching the Previdência Social ceiling.

For a full breakdown of INSS rules, ceilings, and contribution brackets, consult:

🔗 Social Security Tax in Brazil.

INSS – Social security contribution

The first calculation corresponds to the amount that goes to Social Security. From your gross salary, the deduction is made according to the following table:

Social security contributions paid by employees are capped at BRL R$ 951,62 per month.

Example:

Gross salary: R$ 8,000.00

INSS: R$ 951,62 (example based on progressive table)

Since the INSS table changes with inflation, it is important to check annual updates.

Minimum wage resources:

🔗 Minimum Wage in Brazil

🔗 Minimum Salary 2026 Projection

3. Deduct Eligible Dependents

Each legal dependent allows a monthly deduction of R$ 189.59 from the IRRF base. Dependents may include minor children, spouses, and financially dependent parents.

Example:

IRRF base before dependents: R$ 7.048,38

One dependent: –R$ 189.59

New IRRF base: R$ 6.858,79

These deductions must be declared by the employee and updated regularly to avoid incorrect taxation.

4. Check the Updated IRRF Table

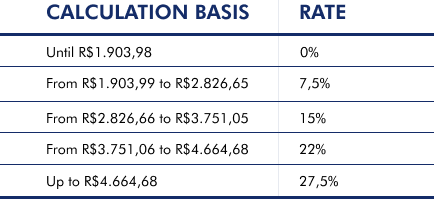

IR – Individual Income Tax

The second calculation corresponds to the individual income tax that the employee has to pay. You must deduct the INSS from the gross salary to correctly calculate the individual income tax (IR). Find below the IR contribution table

Example: Employee receiving a gross monthly salary of R$ 2500. You will have to deduct R$209 for the INSS.

- Calculate the calculation basis: R$2500 – R$209 = R$2291

- Calculate the IR: (2291 – 1903,99) * 7,5% = 29,03

In total, the IR deduction states at R$ 29,03 per month.

Step 3 : Calculate for net salary in Brazil

When you have your gross pay and the sum of your deductions, calculating your net pay is relatively easy. To do this, subtract your deductions from your gross pay. Use the following formula to calculate your net pay:

NET PAY = GROSS PAY – DEDUCTIONS

Example: Employee receiving a gross monthly salary of R$ 2500.

Net pay = 2500 – ( 209 + 29,03) = 2261,97

The net salary will be R$ 2261,97

Why Employers Benefit From Automated or Outsourced Payroll

Brazil’s payroll legislation changes frequently due to tax updates, inflation adjustments, and regulatory reforms. Automated payroll systems or trusted Employer of Record partners help companies:

Reduce human error

Apply updated INSS and IRRF tables automatically

Maintain compliance with Brazilian regulations

Produce accurate and transparent payslips

For a deeper overview of employer obligations, see the 🔗 Payroll & Tax Guide.

Streamline Your Expansion with EOR Services in LATAM

Expand across Latin America effortlessly with our Employer of Record (EOR) services. We handle compliance, payroll, and employee management, ensuring smooth operations while you focus on growing your business.

Simplify payroll and taxes in Brazil with Europortage

Don’t let the complexities of running payroll in Brazil stop you from engaging top local talent and building your dream team in the country. With the right partner, hiring and paying employees in Brazil is easy.

Europortage’s EOR solution makes it simple for global companies to hire and pay talent in Latin America, including Brazil, without establishing local entities or risking noncompliance.

Lean on us to hire, pay, and manage your employees in Brazil so you can build a distributed workforce in the country with ease.

FAQ

Which deductions reduce IRRF?

INSS, dependent deductions, and eligible alimony payments.

Is IRRF final or later adjusted?

IRRF works as a prepayment. Employees reconcile taxes in their annual declaration.

Do minimum-wage employees pay IRRF?

No. Salaries at the exemption range are not taxed. Latest updates here:

🔗 Minimum Salary 2026 Projection

Who is responsible for paying IRRF?

Employees pay the tax, but employers must calculate, withhold, and remit it.